Weekly questions I’ve been receiving and my answers:

“How can you afford taking a year off of work?”

I set my priorities and focus on what matters to me in life. Read below.

“Must be nice being a trust fund baby and having mommy and daddy fund your adventures eh?

Shut the f**k up. Sure, through education and exceptional parenting, they set me on a path at a young age to pursue my dreams and I am forever grateful. But this year and my life is paid for by me.

Are you throwing your money away for one crazy year and not being financially smart?

Yes I’ll take a huge financial cut. But experiences in life are valuable to me. Plus they will grow this year and who knows where that could lead. Also, as you’ll read below, I still invest in my future and plan for success.

After a multitude of questions about how I’ll finance this year, I wanted to explain it in one cohesive post. Avoiding direct income, savings, and investment numbers, I’ll explain how I approach this “gap” year of sorts.

There’s the old cliché question “what do you want to be when you grow up?” Honestly, I don’t know. But I do know what makes me happy. I truly enjoy taking people into the outdoors and creating “momentary highs” for others. I also love rock climbing, freediving, skiing, hunting, and mountain biking. So my answer would be I want a career that lets me do those activities as much as possible while also showing and teaching others the beauty of the outdoors.

Once you know what makes you happy you can pursue it. I have friends who simply want to be rich. That’s awesome! They pursue careers that create the financial freedom they seek while doing a job that personally would make my head explode. For me, money is simply a means to obtain the end goal of pursuing my interests.

A year like this requires a mindset shift. If I need to see a slightly smaller number in the bank account to wrack up a wealth of meaningful experiences, so be it. If I need to live somewhat frugally to redirect that income towards travel and gear expenses, so be it. I read a lot of investment books and articles to understand financial stability and saving for the future. I am not discounting that. I personally invest in a retirement account and will continue to do so during this year. But I don’t see the textbook American life of working tirelessly through adulthood and saving for freedom after retirement as the rule. I just turned 27 years old. I have never felt healthier, stronger, and more mountain-fit than right now. Why not use that while I have it and chase what makes me happy? Also, not to be grim and pessimistic, but who knows if I’ll live to that retirement age? I’ve had several friends pass away unexpectedly. While I completely plan and hope to live a full and beautiful life, stuff happens. These friends have given me drive to live every year to the fullest.

Ok, now to the funding. The basic idea is spend where I have to, cut expenses where I can, and be ok with digging into the money I made previously. All the while I won’t skimp on creating meaningful “momentary highs”. Any financial hole I dig myself into I must trust I can dig myself out of later. Actually, in my mindset, I am becoming wealthy this year! Just maying not in a dollar sign, but rather in memories and friendships that are worth millions.

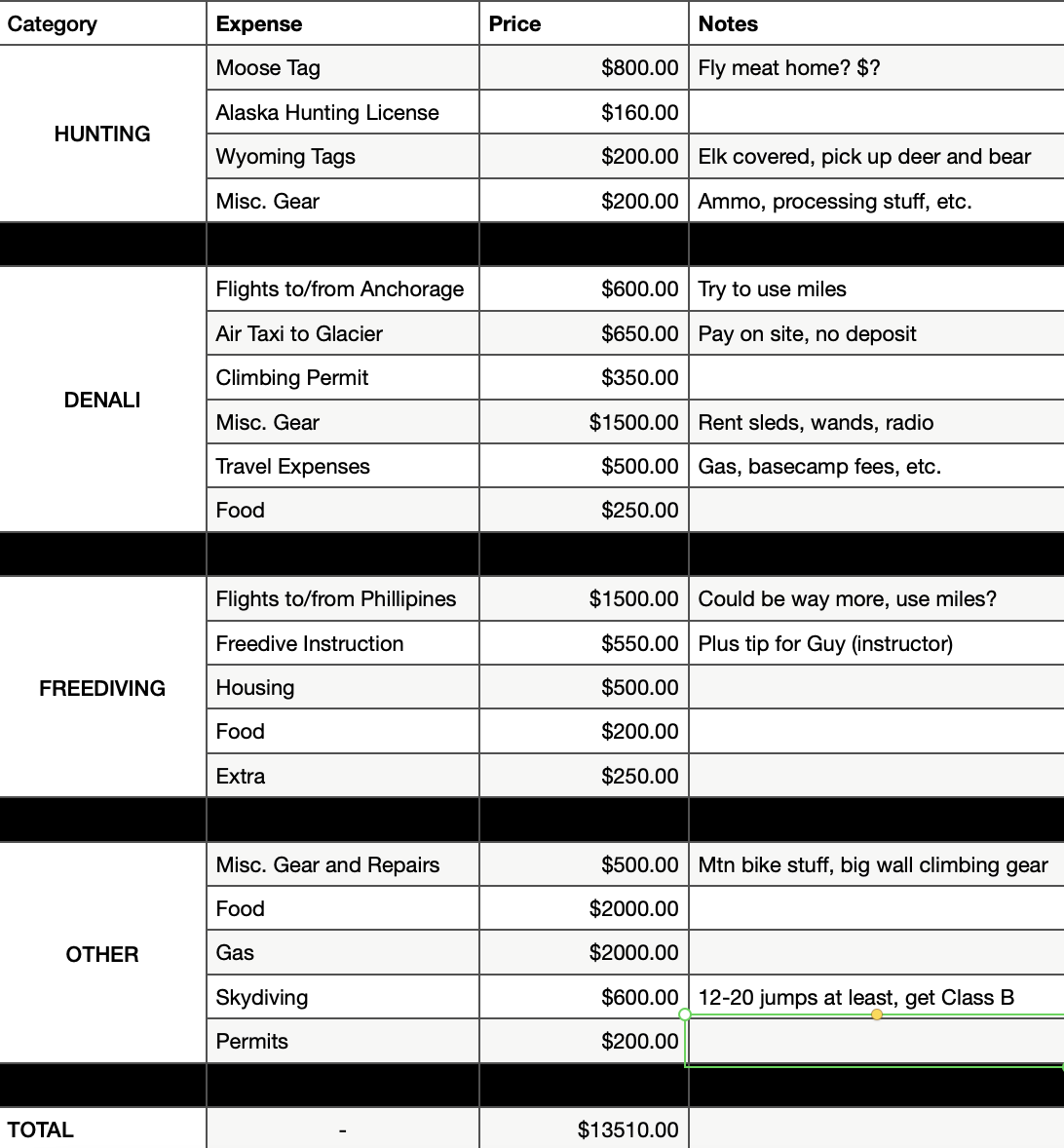

Below is a breakdown of the major costs I expect to incur this year.

As you can see the total cost should be around $13,500. I tried to round up for any estimated expenses. That being said, let’s add another $500 for random costs that may arise.

Total Estimated Cost: $14,000

With that baseline, I can begin cutting expenses out of my life. The major one is housing. Starting April 1st, I will move back into my car and thus have zero rent payments until December. It may be November but let’s go with December for now. That’s 8 months of not paying my $1000/month Jackson rent.

Housing Savings: $1000 x 8 = $8000

Next I will cancel my gym membership. I love that place. I used to work there plus I used it for showers, wifi, and workouts when I lived out of my car regularly. I’ll reinstate it when I’m back.

Cancel Gym Membership: $60 x 8 = $480

Next I can assume I won’t be eating out in Jackson as much since I’ll be on the road most of the year. My diet will consist of cheap groceries and beer, plus elk and bear meat of course. I am not a penny-pincher though. When in Jackson this year I’ll ball-out and eat/drink with friends. But assuming less restaurant consumption, I imagine I’ll save quite a bit.

Price of eating out in Jackson: $500-$1000

With those three key avenues of saving, I should bank $9-10k that I would normally spend otherwise. The realized cost of this year suddenly becomes less.

*For simplicity, I have left out monthly costs of health insurance, contributions to my IRA, and the like since those would exist no matter what I do this year.

Realized Cost: $4000

*Loss of Income (opportunity cost): This I don’t want to talk about. It would be weird to share my annual earnings publicly. Plus, I live in a seasonal area with seasonal income so that number is wildly different each year. True, I’d make and save a lot more if I worked these 8 months. And true I’d experience the compound interest earnings of that money then being invested. To consider this would skyrocket the realized cost of this year. But what is the price of our happiness? The price of accomplishing goals? For me it is way more than I could ever make in several years working. For me the decision to not work this year is an easy one. I can buckle down and grind when I get back. In fact, the largest cost of this year is not financial at all. It’s the fact I’ll be gone from Jackson for a month here and month there. I’ll miss my Jackson family so much.

Some have found the price of this year surprisingly low. Others have been surprised how much outdoor recreation can cost. It depends on the audience. The latter has a good point however. Outdoor recreation isn’t cheap. The gear required to stay safe and comfortable in harsh conditions is expensive. Not to mention permits and instruction should you need them. But there are ways to cut it. First off, always camp in dispersed National Forest land and avoid campground fees. Next, acquire the training and abilities to go unguided. If Tanner, Tim, and I wanted a guided expedition on Denali - holy crap it would cost more than I’ll spend this entire year.

Money is a funny thing. More people have asked about the financial situation of this year than the effort and training required to complete these objectives. I hope this explanation helps. And again, NO, I am not your stupid trust fund Jackson baby so stop bringing it up. I just work hard in order to play really hard. And I value experiential wealth. I may be poor but I am gear, experience, and memory rich.